-

play_arrow

play_arrow

Georgia NOW Live Streaming Now

-

play_arrow

play_arrow

Deported GA Army veteran, Savannah ICE chase expose flaws in DHS & immigration procedures

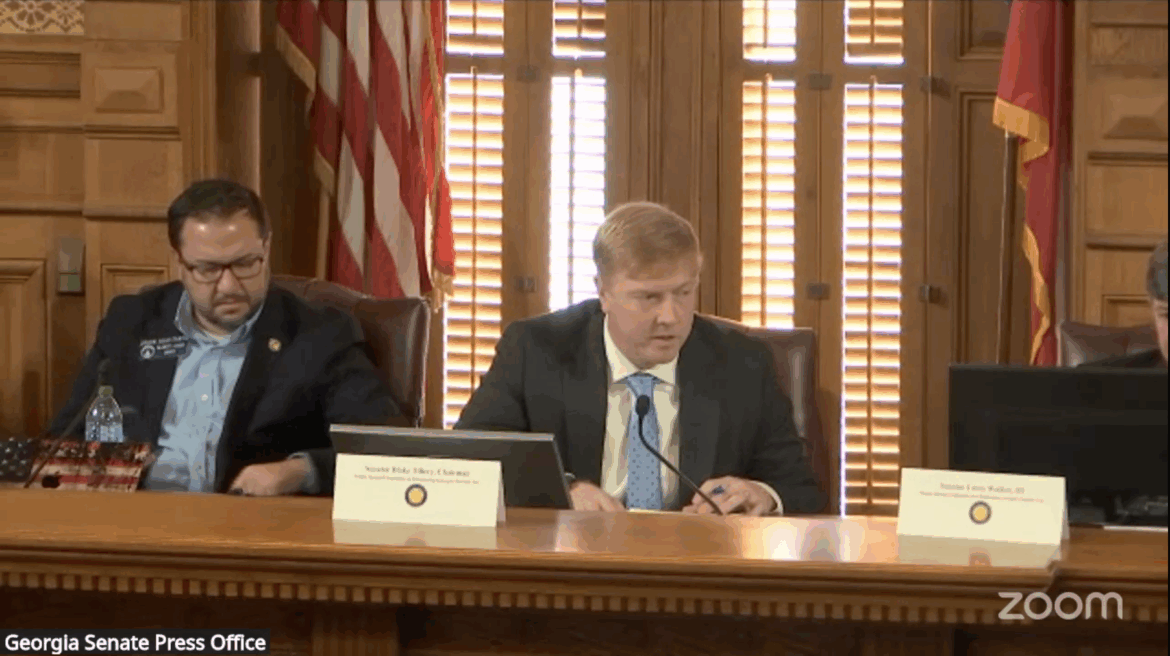

State Sen. Blake Tillery, chairman of the special committee for eliminating the state's income tax, thanks Dr. Arthur B. Laffer for testifying at the meeting on Nov. 17. Sen. Jason Anavitarte sits to the left of Tillery. Credit: Georgia Senate Press Office livestream

Georgia Senators consider ending state income tax, proposal could raise sales tax to 12%

A committee of Georgia state senators met for the fourth time on Monday to discuss the potential to eliminate Georgia’s income tax.

State Sen. Blake Tillery, the committee chair, began the meeting by reminding those present why the senators were discussing this issue.

“I think it’s evident if you’ve watched anything in recent news stories or even the recent elections that folks are really feeling the pinch in their own homes whether it be on groceries, gas, child care,” Tillery said.

Georgia Public Policy Foundation President Kyle Wingfield testified before the committee, and highlighted benefits of eliminating the income tax in Georgia.

“When you lower the rate and you do it on a permanent basis, you’re telling business owners, you’re telling entrepreneurs, you’re telling households, your money is going to go farther in the future than it used to,” he said. “That’s a powerful incentive for people to work more, to save more, and to invest more. And those three things are the lifeblood of our economy and the growth of our economies.”

Patrice Onwuka, director of Independent Women’s Center for Economic Opportunity, said lifting the state income tax could specifically benefit women and the economy in Georgia.

“We are a powerful economic agent as consumers, producers, and investors,” she said. “Women are very sensitive to tax policy. Now, number one, eliminating the income tax empowers women to cope with today’s affordability crisis.”

The state would need to increase the sales tax rate to 12% to compensate for the loss in revenue of eliminating the income tax, according to a Georgia Budget and Policy Institute report. That is three times the current sales tax rate. The report states that this move would transfer wealth from the middle class to high-income individuals.

Senate Democrats Nan Orrock and Ed Harbison, who are both members of the special committee, released a joint statement Monday criticizing the effort.

“Republicans want to jack up taxes on the middle class to give rich people a massive handout. This handout will make raising a family, buying a house or running a business more expensive. Almost every Georgian would see their tax bill increase by a month’s worth of groceries. At the end of the day, they’re making the affordability crisis worse and saying they’re doing you a favor. Democrats on this committee are appalled by this wrongheaded, disastrous proposal,” read the statement.

Written by: Jenna Eason

Similar posts

-

The Thom Hartmann Program

Weekdays at 1pm

Thom Hartmann is a New York Times bestselling, four-times Project Censored Award-winning author and host of The Thom Hartmann Program, which broadcasts live nationwide each weekday from noon to 3pm Eastern. For 20 years, the show has reached audiences across AM/FM stations throughout the US, on SiriusXM satellite radio, and as video on Free Speech TV, YouTube, Facebook, and X/Twitter.

close  From CBS News

From CBS News- Judge who held DOJ lawyer in contempt blasts handling of immigration cases February 21, 2026A federal judge who took the extraordinary step of holding a government lawyer in contempt of court earlier this week blasted the Justice Department for its handling of immigration cases on Friday.

- House Speaker denies request for Jesse Jackson to lie in honor at Capitol February 21, 2026House Speaker Mike Johnson's office has denied a request to have the late Rev. Jesse Jackson lie in honor in the U.S. Capitol Rotunda due to past precedent.

- Court clears way for Louisiana law requiring public schools display Ten Commandments February 21, 2026The 5th Circuit Court of Appeals has cleared the way for a Louisiana law requiring poster-sized displays of the Ten Commandments in public classrooms to take effect.

- This week on "Sunday Morning" (Feb. 22) February 21, 2026A look at the features for this week's broadcast of the Emmy-winning program, hosted by Jane Pauley.

- 2/20: CBS Evening News February 21, 2026Trump lashes out at Supreme Court after justices strike down his tariffs; Man's cat sanctuary naps still helping rescue expand years after they first went viral

- No charges for Labor secretary's husband after being banned from building February 21, 2026Labor Secretary Lori Chavez-DeRemer's husband was banned from the Labor Department building after agency employees alleged he had touched them inappropriately, sources said.

- Bomb cyclone threatens East Coast, violent tornado hits southern Illinois February 21, 2026A fast-developing bomb cyclone is threatening the East Coast with yet another severe round of winter weather. CBS Boston chief meteorologist Eric Fisher has the forecast. Then, Tom Hanson has more about a violent tornado that touched down in southern Illinois.

- The latest GDP data isn't as bad as it looks. Here's what to know. February 21, 2026A simple reason explains why U.S. economic growth seemed to hit a wall in the final three months of the year.

- Trump tells Pentagon to release files on UFOs and "alien and extraterrestrial life" February 21, 2026President Trump directed his administration to release files on UFOs and any "alien and extraterrestrial life," an issue that has drawn decades of fascination — and spawned more than a few wild theories.

- Will Americans get refunds after Trump's tariffs were overturned by the Supreme Court? February 21, 2026While the Supreme Court struck down the Trump administration's emergency tariffs, experts said it could take years for businesses to get refunds.

- Judge who held DOJ lawyer in contempt blasts handling of immigration cases February 21, 2026

Copyright Georgia NOW Radio - 2026

Post comments (0)