-

play_arrow

play_arrow

Georgia NOW Live Streaming Now

-

play_arrow

play_arrow

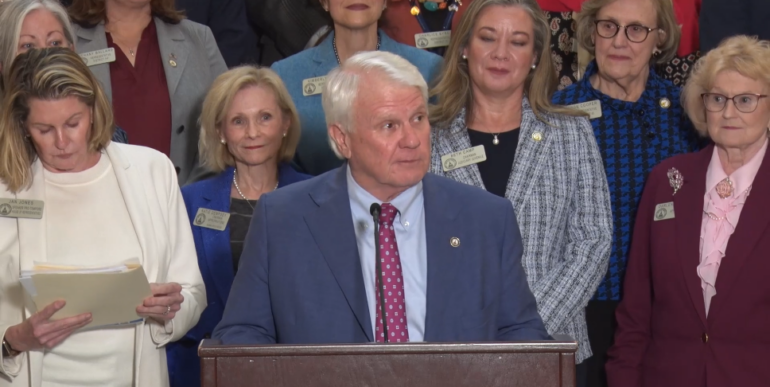

GA lawmaker's move to shield carpet industry from PFAS fallout should yield a Democratic candidate

Debt can strain young adults during the holidays. Experts have tips on coping

Credit card balances often climb at the end of the year, and for many young adults, the added financial pressure can take a toll on mental health.

Assistant professor at University of Georgia’s School of Social Work Gaurav Sinha, told Georgia Public Broadcasting that financial strain and emotional well-being are closely linked — particularly for people ages 18 to 34. He said debt can contribute to stress, anxiety and, in more serious cases, depression.

“People tend to buy gifts, host parties, travel, and you have to put a lot of thinking in that, right?” Sinha said. “People constantly, they stress about like, ‘How much I can spend? What should I buy?’”

He said it’s important to recognize when financial goals and holiday expectations are competing for attention. That tension can weigh heavily on mental health, especially when people feel obligated to stretch their budgets to meet social or family expectations.

Sinha recommends carving out time to rest and taking short breaks while planning seasonal activities can help ease the emotional load that often comes with holiday spending.

Written by: georgianow

coping with holiday debt credit card debt Georgia financial strain holidays Georgia mental health Georgia NOW news holiday budgeting tips holiday spending stress seasonal anxiety UGA School of Social Work young adult debt

Similar posts

-

The Stephanie Miller Show

Weekdays at 10am

National morning drive radio and television star Stephanie Miller hosts The Stephanie Miller Show, reaching over six million listeners weekly on satellite and terrestrial radio, simulcast on FreeSpeech TV. A ratings powerhouse who dominated at KABC, KFI, and stations in New York and Chicago, she's been ranked on Talkers Magazine's "Heavy Hundred" for over a decade and won their Woman of the Year Award. Her sold-out Sexy Liberal Comedy Tour became the fastest-selling comedy tour in history, earning three Pollstar nominations and producing America's #1 comedy album. Praised by Rachel Maddow as "the high priestess of excellent liberal talk" and by Carol Burnett as "the Carol Burnett of radio," this Liberal icon—ironically the daughter of Barry Goldwater's 1964 VP running mate—is known as "The Voice of The Resistance."

close  From CBS News

From CBS News- White House files most detailed plans yet for Trump ballroom, East Wing renovation February 13, 2026The filing includes new renderings of the new East Wing, relative to other buildings close to the ballroom and from vantage points near the U.S. Capitol, Jefferson Memorial and points around the White House campus.

- Arizona sheriff in Nancy Guthrie search defends sending DNA to Florida lab February 13, 2026Pima County Sheriff Chris Nanos said the results that investigators have received from DNA testing in the Nancy Guthrie case so far haven't led to a suspect.

- Amazon ends Flock partnership after backlash over Super Bowl ad February 13, 2026Amazon's Ring unit touted a "search party" service in its Super Bowl ad, but one critic called the app a "surveillance nightmare."

- Athletes to watch from Team USA at the Winter Olympics February 13, 2026American athletes are going for the gold at the 2026 Milano Cortina Winter Olympics. These are some of the top Team USA competitors to watch.

- Girl looking for a date to a school dance was murdered a week later February 13, 2026Mary Kay Heese, 17, was found stabbed to death in a field in March 1969. Fifty-five years later, a suspect was arrested — someone who had been on investigators' radar for decades.

- Ilia Malinin misses Olympic medal after falling in free skate, finishes 8th February 13, 2026In a shocking twist at the 2026 Winter Olympics, American figure skater Ilia Malinin didn't make it to the podium after falling twice during the free skate. Kazakhstan's Mikhail Shaidorov took home the gold.

- Today's CPI report is the best inflation news in months. Here's why. February 13, 2026The inflation reading, the lowest since May 2025, shows grocery, gas and rent prices are cooling.

- DOJ drops case against 2 men accused of assaulting ICE, citing new evidence February 13, 2026A judge dismissed charges against two men charged with assaulting ICE officers after the Justice Department said "newly discovered evidence" was "materially inconsistent" with the allegations.

- What services would be affected by a DHS government shutdown? February 13, 2026Funding for the Department of Homeland Security will expire at the end of the day Friday. Here's what will be affected.

- 8/10/2025: The Cap Arcona; Jamie Lee Curtis February 13, 2026First, a report on the sinking of the Cap Arcona Nazi ship. And, Jamie Lee Curtis: The 60 Minutes Interview.

- White House files most detailed plans yet for Trump ballroom, East Wing renovation February 13, 2026

Copyright Georgia NOW Radio - 2026

Post comments (0)