-

play_arrow

play_arrow

Georgia NOW Live Streaming Now

-

play_arrow

play_arrow

Deported GA Army veteran, Savannah ICE chase expose flaws in DHS & immigration procedures

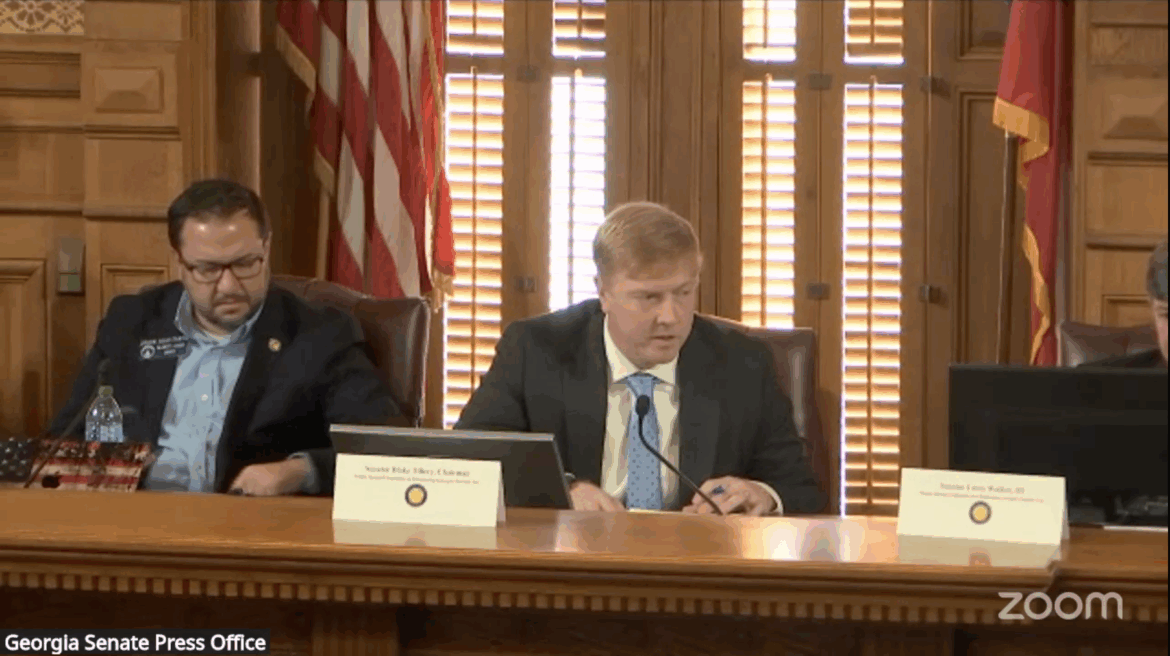

State Sen. Blake Tillery, chairman of the special committee for eliminating the state's income tax, thanks Dr. Arthur B. Laffer for testifying at the meeting on Nov. 17. Sen. Jason Anavitarte sits to the left of Tillery. Credit: Georgia Senate Press Office livestream

Georgia lawmakers eye income tax repeal, revive key tax bills for 2026 session

The 2026 legislative session is expected to begin Jan. 12, and several issues regarding taxes are expected to be introduced or recalled from the 2025 session.

A major focus will be to entirely eliminate the state income tax. The Senate Special Committee on Eliminating Georgia’s Income Tax held several meetings exploring the possibility towards the end of 2025.

State Sen. Blake Tillery, the committee chair, said the issue is in the forefront of people’s minds this year.

“I think it’s evident if you’ve watched anything in recent news stories or even the recent elections that folks are really feeling the pinch in their own homes whether it be on groceries, gas, child care,” Tillery said.

Georgia Public Policy Foundation President Kyle Wingfield testified before the committee arguing that the change would be a powerful contributor to the state’s economy.

However, a Georgia Budget and Policy Institute report found that the state would need to increase its sales tax rate to 12% to account for the loss in revenue.

House Bill 111 already reduced the flat individual and corporate income tax rate to 5.09%, which goes into effect Thursday. A further reduction to 4.99% by 2027 is included in the bill provided certain revenue thresholds are met.

Other tax legislation is expected to be discussed that was held over from the 2025 session:

- SB 89: The bill would modify or create three child tax credits reducing tax revenue in the state by nearly $180 million in 2026. It establishes a $250 tax credit for each qualifying child under age seven, increases the state credit for child and dependent care expenses from 30% to 40% of the federal credit and modifies the existing employer sponsored childcare tax credit.

- SB 129: Also known as “Georgia Supporting Those Who Sacrificed for Service Act,” this bill would offer more tax relief to disabled veterans and first responders by expanding homestead exemptions. Because the bill is a constitutional amendment, it will need voter approval in November 2026.

- HB 328: This bill would increase the state’s tax credit cap on donations to student scholarship organizations from $120 million to $140 million.

Written by: Jenna Eason

2026 legislative session child tax credit cost of living economic policy Georgia economy Georgia House Georgia income tax Georgia lawmakers Georgia Legislature Georgia Senate Georgia tax reform Georgia taxes state budget tax policy veterans benefits

Similar posts

-

Democracy Now!

Weekdays at 11pm

Democracy Now! is an hour-long American TV, radio, and Internet news program that airs live each weekday at 8 a.m. Eastern Time, broadcast on the Internet and via more than 1,400 radio and television stations worldwide. Hosted by award-winning journalists Amy Goodman, Juan González, and Nermeen Shaikh, the show is a daily independent global news hour pioneering the largest community media collaboration in the U.S. The program combines news reporting, interviews, investigative journalism, and political commentary from a progressive perspective, documenting social movements, struggles for justice, activism challenging corporate power, and operating as a watchdog regarding the effects of American foreign policy. Democracy Now! is funded entirely through contributions from listeners, viewers, and foundations—accepting no advertisers, corporate underwriting, or government funding.

close  From CBS News

From CBS News- Nancy Guthrie investigators turn to genetic genealogy. It's worked in big cases before. February 20, 2026Investigators in the Nancy Guthrie case have turned to genetic genealogy as they try to make the most of potential DNA evidence.

- Will Americans get refunds after Trump's tariffs were overturned by the Supreme Court? February 20, 2026While the Supreme Court struck down the Trump administration's emergency tariffs, experts said it could take years for businesses to get refunds.

- Olympic gold medalist Alysa Liu's advice for aspiring figure skaters February 20, 2026Alysa Liu stunned the skating world by retiring at age 16. Two years later, she returned to the ice, and now she's won gold at the Winter Olympics.

- This week on "Sunday Morning" (Feb. 22) February 20, 2026A look at the features for this week's broadcast of the Emmy-winning program, hosted by Jane Pauley.

- Book excerpt: "We the Women" by Norah O'Donnell February 20, 2026In her new book, the CBS News journalist highlights women who pushed America to live up to its founding promises of liberty, equality, and the pursuit of happiness for all.

- U.S. fighter jets intercept Russian warplanes off Alaskan coast February 20, 2026Two Russian Tu-95s bombers, two Su-35s fighter planes and an A-50 spy plane were detected in the Alaskan Air Defense Identification Zone, NORAD said.

- Trump lashes out at his own Supreme Court picks over tariff ruling February 20, 2026President Trump said he was "ashamed of certain members of the court" after the Supreme Court struck down most of his tariffs.

- Fried rice sold at Trader Joe's recalled over possible glass contamination February 20, 2026The recall involves 3.4 million pounds of frozen chicken fried rice products shipped to Trader Joe's locations nationwide and to retailers in Canada.

- Athletes to watch from Team USA at the Winter Olympics February 20, 2026American athletes are going for the gold at the 2026 Milano Cortina Winter Olympics. These are some of the top Team USA competitors to watch.

- American Alex Ferreira wins his first Olympic gold in freeski halfpipe February 20, 2026Alex Ferreira's first gold medal came after he took silver in Pyeongchang in 2018, and the bronze four years ago in Beijing.

- Nancy Guthrie investigators turn to genetic genealogy. It's worked in big cases before. February 20, 2026

Copyright Georgia NOW Radio - 2026

Post comments (0)